Learn. About the plan

If you are a full-time employee, you can join the YouFlex plan if you:

- Are a permanent employee;

- Reside in Canada;

- Are actively at work;

- Have completed the two-month waiting period; and

- Work a minimum of 32 hours per week.

If you are a part-time employee, you can join the YouFlex plan if you:

- Are a permanent employee;

- Reside in Canada;

- Are actively at work; and

- Have completed at least 26 weeks of continuous employment from the first day of the month following your date of hire and have worked at least 600 hours (390 hours if you live in Saskatchewan).

If a part-time employee does not complete the waiting period in the first 26 weeks of employment, the waiting period for the subsequent plan year’s coverage is the completion of at least 1,200 hours (780 hours for employees residing in Saskatchewan) in a full calendar year.

After the first year of being covered under the plan, part-time employees must work a minimum of 780 hours per calendar year to maintain eligibility under the plan.

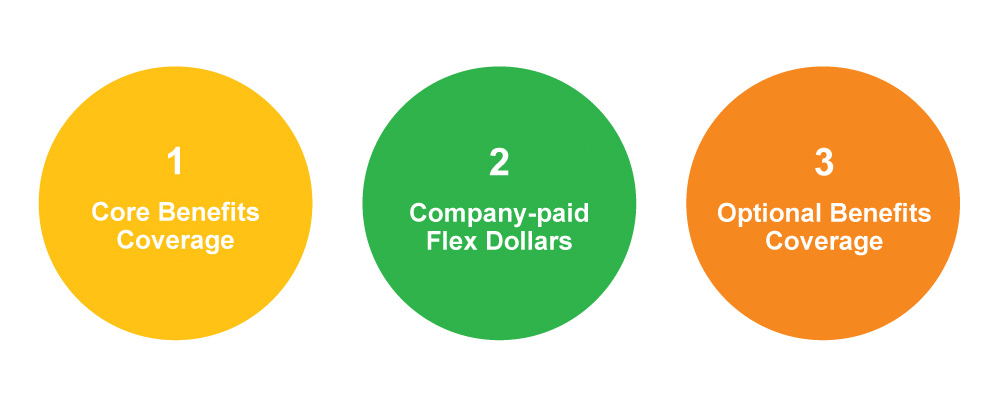

The YouFlex plan has three components:

Full-time Employee Coverage. Read more... Read less...

Part-time Employee Coverage. Read more... Read less...

If you received an annual re-enrolment email or a postcard, you are eligible to make changes to your coverage or join the plan if you’re not currently enrolled, as long as you act between March 1 and 14. All coverage changes will take effect on May 1, 2024.

- YouFlex benefits provide you with Flex Dollars during each annual re-enrolment.

- Flex Dollars are used to help pay for the cost of the benefits you elect.

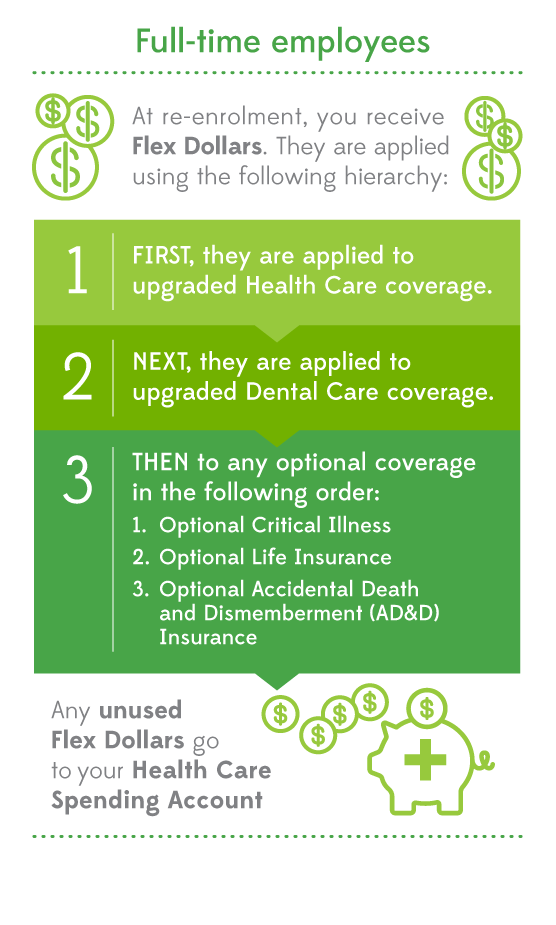

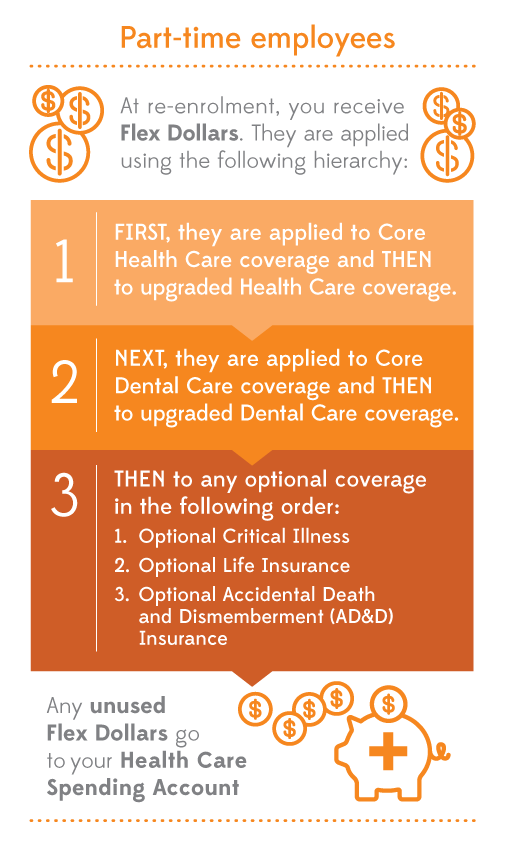

- Flex Dollars are first applied towards your Health Care and Dental Care options. Depending on the level of coverage you choose, you may also have enough Flex Dollars to put towards additional optional insurance benefits, including Critical Illness, Life Insurance and AD&D Insurance.

- Each benefit option has a price tag that represents the cost of the benefit which you will be able to see as you are enrolling or re-enrolling. The cost of your coverage depends on the options you choose and the number of dependents you cover.

- After you’ve made your choices, you may have unused Flex Dollars left over, which will be directed to your Health Care Spending Account (HCSA).

Can Long Term Disability (LTD) premiums be paid with Flex Dollars?

- No. Long Term Disability premiums (for full-time employees only) are automatically paid through payroll deductions.

- Flex Dollars are Company payments. By paying your LTD premiums with payroll deductions, in the event you become disabled and qualify for LTD benefit payments, those LTD payments will not be subject to income tax.

Flex Dollar hierarchy

When choosing your benefits, your Flex Dollars are distributed based on a hierarchy. Whether you have enough Flex Dollars to cover all your benefit elections depends on the coverage level you choose when selecting your benefits.

Here’s how it works:

- Full-time employees. Read more...

- Part-time employees. Read more...

Where does the money come from?

Any unused Flex Dollars are deposited into a Health Care Spending Account (HCSA) for you at Medavie Blue Cross.

You can receive reimbursement from an HCSA for health and dental expenses not covered under:

- YouFlex;

- Your spouse’s plan; or

- Your provincial health care plan.

Eligible expenses are any medical expenses that you would be able to claim on your income tax return. This includes things like deductibles, amounts above the plan maximums and more—the list is long! The Canada Revenue Agency (CRA) decides what’s eligible—take a look.

In accordance with CRA rules, you have two years to use the money in your account, or you lose it! Here’s how it works:

- If you do not use the full balance in your HCSA in the year it is allocated, your unused account balance can be carried over into the next plan year.

- You must “use or lose” your year one remaining balance (the “carry-over”) before the end of year two.

How do I know if I have an HCSA? Read more...

Download the Medavie Mobile App

Join 80% of Sobeys employees who have downloaded the Medavie Mobile App on the Apple or Google Play app stores. Once you register and log in, you’ll be able to:

- Look up benefit details and your HCSA balance

- Submit a claim

- Search for dentists and health professionals in your area, as well as those who offer ePay services—they’ll submit the claim so you won’t have to!

- Access your ID card

- And more

Take a look at the options available to you.

- Core

- Enhanced

- Premium

YouFlex benefits provide you with three different levels of dental care coverage:

- Core

- Enhanced

- Premium

YouFlex benefits provide full-time employees with Short Term Disability coverage and a choice of three levels of Long Term Disability coverage:

- Core

- Enhanced

- Premium

Learn more about Critical Illness coverage, Life Insurance and Accidental Death and Dismemberment Insurance coverage.

Dialogue is a virtual health care platform that allows employees enrolled in Health Care coverage under the YouFlex plan (and their spouses and children) to consult health care professionals anytime, from anywhere across Canada.

Available 24/7, the on-demand service means that medical consultations happen when and how they need to. Following a virtual consultation, patients can expect to receive a care plan, navigation support, follow-ups, referrals to specialists, lab requests, self-management resources and more.

To create your Dialogue account just follow these steps!

- Download the Dialogue app on your smartphone or tablet.

- Click on “Get started”.

- Enter your First Name, Last Name and Date of Birth.

- Enter your Postal Code.

- Enter your preferred email address, create a password and follow the instructions on the screen to complete your profile.

Or you can go to dialogue.co/Sobeys on your computer and follow the steps to enrol.

Keep your beneficiary(ies) up to date

Do you have a confirmed beneficiary on file? It ensures that:

- Your Life and AD&D insurance benefits are paid to your beneficiary (rather than your estate); and

- The benefits are not paid to someone you don’t want to receive them.

If there is no confirmed beneficiary on file, your insurance benefit will be paid to your estate.

If the only form on file is out of date, any insurance benefit will be paid to that person, no matter what your current intention might be.

You can now review, update (if necessary) and confirm your beneficiary all online on the YouFlex benefits re-enrolment site.